Why do firm go international , read more ⊕

Tag: academic theory

theories. academic frameworks. articles. blogs and signposts to other content.

Market entry

Gaining and sustaining competitive advantage

Tariff

The most common way to protect one’s economy from import competition is to implement a tariff: a tax on imports. Generally speaking, a tariff is any tax or fee collected by a government. Sometimes the term “tariff” is used in a nontrade context, as in railroad tariffs. However, the term is much more commonly used to refer to a tax on imported goods. Read more

Source:Policy and Theory of International Trade from http://2012books.lardbucket.org

What Is Economics?

To appreciate how a business functions, we need to know something about the economic environment in which it operates. We begin with a definition of economics and a discussion of the resources used to produce goods and services.

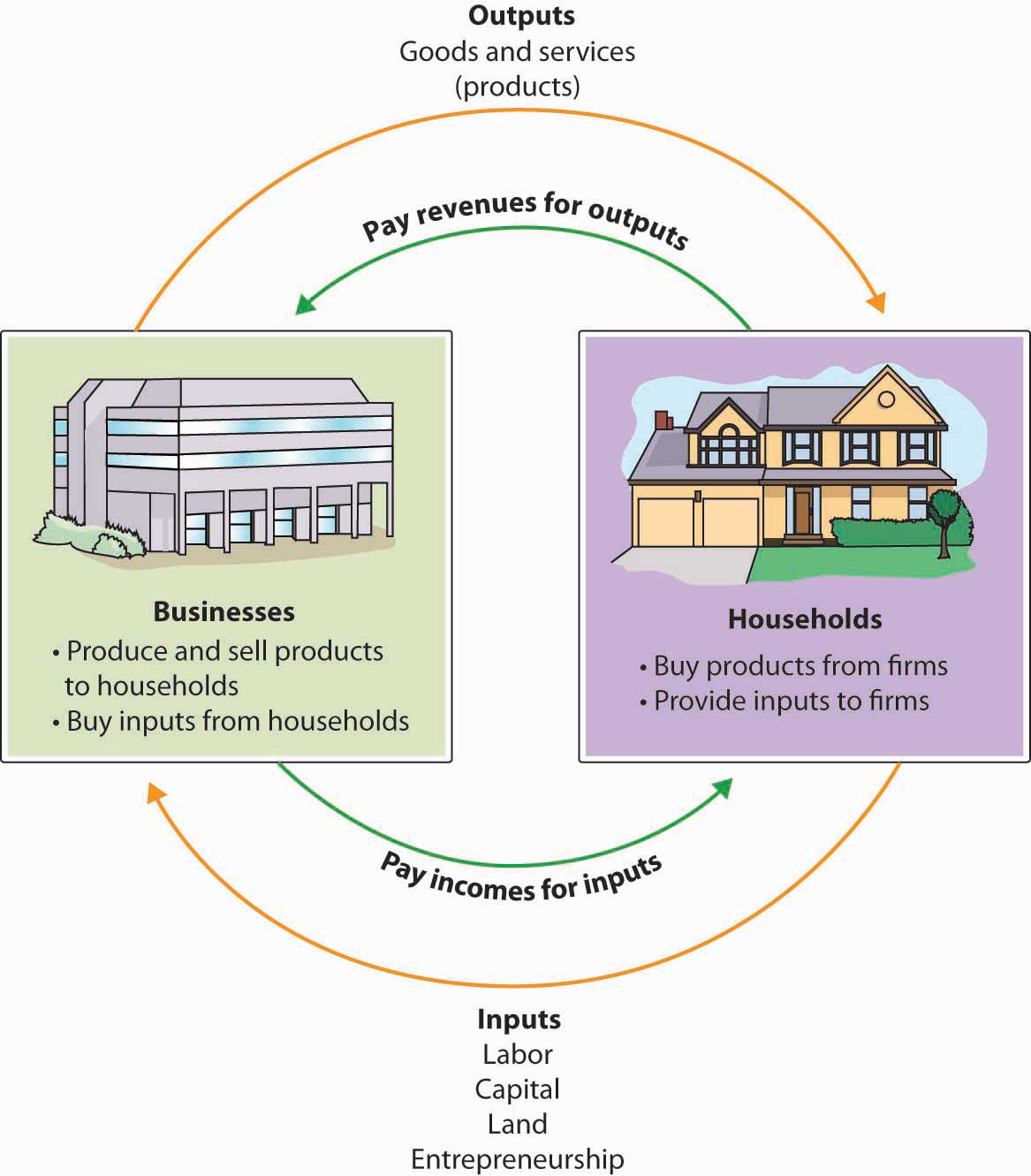

Resources: Inputs and Outputs

Economics is the study of how scarce resources are used to produce outputs—goods and services—to be distributed among people. Resources are the inputs used to produce outputs. Resources may include any or all of the following:

- Land and other natural resources

- Labor (physical and mental)

- Capital, including buildings, equipment, and money

- Entrepreneurship

Resources are combined to produce goods and services. Land and natural resources provide the needed raw materials. Labor transforms raw materials into goods and services. Capital (equipment, buildings, vehicles, cash, and so forth) are needed for the production process. Entrepreneurship provides the skill and creativity needed to bring the other resources together to capitalize on an idea.

Because a business uses resources to produce things, we also call these resources factors of production. The factors of production used to produce a shirt would include the following:

- The land that the shirt factory sits on, the electricity used to run the plant, and the raw cotton from which the shirts are made

- The laborers who make the shirts

- The factory and equipment used in the manufacturing process, as well as the money needed to operate the factory

- The entrepreneurship skill used to coordinate the other resources to initiate the production process

Input and Output Markets

Many of the factors of production (or resources) are provided to businesses by households. For example, households provide businesses with labor (as workers), land and buildings (as landlords), and capital (as investors). In turn, businesses pay households for these resources by providing them with income, such as wages, rent, and interest. The resources obtained from households are then used by businesses to produce goods and services, which are sold to the same households that provide businesses with revenue. The revenue obtained by businesses is then used to buy additional resources, and the cycle continues. This circular flow is described in Figure 1.4 “The Circular Flow of Inputs and Outputs”, which illustrates the dual roles of households and businesses:

- Households not only provide factors of production (or resources) but also consume goods and services.

- Businesses not only buy resources but also produce and sell both goods and services.

Figure 1.4 The Circular Flow of Inputs and Outputs

The Questions Economists Ask

Economists study the interactions between households and businesses and look at the ways in which the factors of production are combined to produce the goods and services that people need. Basically, economists try to answer three sets of questions:

- What goods and services should be produced to meet consumers’ needs? In what quantity? When should they be produced?

- How should goods and services be produced? Who should produce them, and what resources, including technology, should be combined to produce them?

- Who should receive the goods and services produced? How should they be allocated among consumers?

Economic Systems

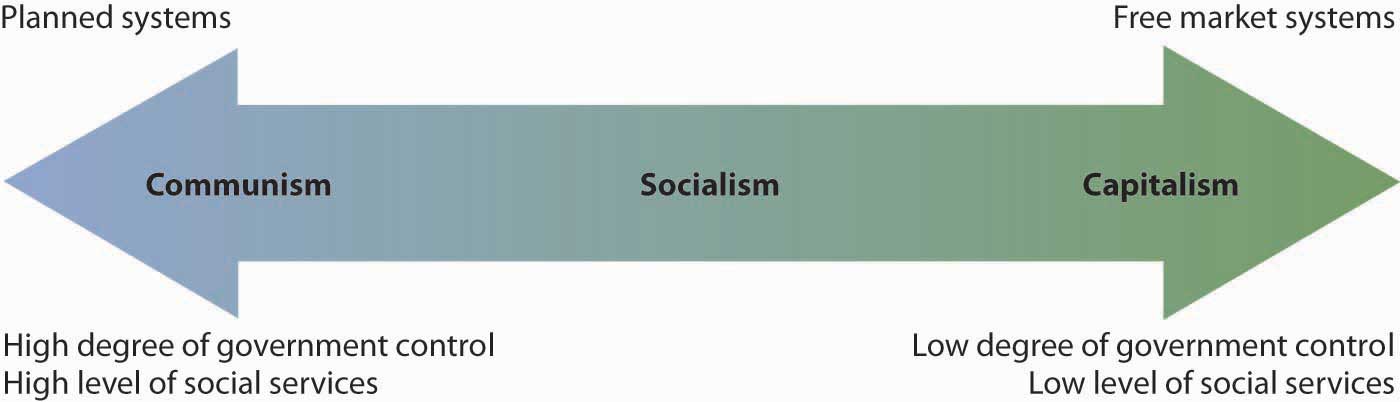

The answers to these questions depend on a country’s economic system—the means by which a society (households, businesses, and government) makes decisions about allocating resources to produce products and about distributing those products. The degree to which individuals and business owners, as opposed to the government, enjoy freedom in making these decisions varies according to the type of economic system. Generally speaking, economic systems can be divided into two systems: planned systems and free market systems.

Planned Systems

In a planned system, the government exerts control over the allocation and distribution of all or some goods and services. The system with the highest level of government control is communism. In theory, a communist economy is one in which the government owns all or most enterprises. Central planning by the government dictates which goods or services are produced, how they are produced, and who will receive them. In practice, pure communism is practically nonexistent today, and only a few countries (notably North Korea and Cuba) operate under rigid, centrally planned economic systems.

Under socialism, industries that provide essential services, such as utilities, banking, and health care, may be government owned. Other businesses are owned privately. Central planning allocates the goods and services produced by government-run industries and tries to ensure that the resulting wealth is distributed equally. In contrast, privately owned companies are operated for the purpose of making a profit for their owners. In general, workers in socialist economies work fewer hours, have longer vacations, and receive more health, education, and child-care benefits than do workers in capitalist economies. To offset the high cost of public services, taxes are generally steep. Examples of socialist countries include Sweden and France.

Free Market System

The economic system in which most businesses are owned and operated by individuals is the free market system, also known as capitalism. As we will see next, in a free market, competition dictates how goods and services will be allocated. Business is conducted with only limited government involvement. The economies of the United States and other countries, such as Japan, are based on capitalism.

How Economic Systems Compare

In comparing economic systems, it’s helpful to think of a continuum with communism at one end and pure capitalism at the other, as in Figure 1.5 “The Spectrum of Economic Systems”. As you move from left to right, the amount of government control over business diminishes. So, too, does the level of social services, such as health care, child-care services, social security, and unemployment benefits.

Figure 1.5 The Spectrum of Economic Systems

Mixed Market Economy

Though it’s possible to have a pure communist system, or a pure capitalist (free market) system, in reality many economic systems are mixed. A mixed market economy relies on both markets and the government to allocate resources. We’ve already seen that this is what happens in socialist economies in which the government controls selected major industries, such as transportation and health care, while allowing individual ownership of other industries. Even previously communist economies, such as those of Eastern Europe and China, are becoming more mixed as they adopt capitalistic characteristics and convert businesses previously owned by the government to private ownership through a process called privatization.

The U.S. Economic System

Like most countries, the United States features a mixed market system: though the U.S. economic system is primarily a free market system, the federal government controls some basic services, such as the postal service and air traffic control. The U.S. economy also has some characteristics of a socialist system, such as providing social security retirement benefits to retired workers.

The free market system was espoused by Adam Smith in his book The Wealth of Nations, published in 1776.According to many scholars, The Wealth of Nations not only is the most influential book on free-market capitalism but remains relevant today. According to Smith, competition alone would ensure that consumers received the best products at the best prices. In the kind of competition he assumed, a seller who tries to charge more for his product than other sellers won’t be able to find any buyers. A job-seeker who asks more than the going wage won’t be hired. Because the “invisible hand” of competition will make the market work effectively, there won’t be a need to regulate prices or wages.

Almost immediately, however, a tension developed among free market theorists between the principle of laissez-faire—leaving things alone—and government intervention. Today, it’s common for the U.S. government to intervene in the operation of the economic system. For example, government exerts influence on the food and pharmaceutical industries through the Food and Drug Administration, which protects consumers by preventing unsafe or mislabeled products from reaching the market.

To appreciate how businesses operate, we must first get an idea of how prices are set in competitive markets. Thus, the next section begins by describing how markets establish prices in an environment of perfect competition.

Source: An Introduction to Business (v. 1.0) from http://2012books.lardbucket.org

Economic Fables

Part memoir, part crash-course in economic theory, this deeply engaging book by one of the world’s foremost economists looks at economic ideas through a personal lens. Together with an introduction to some of the central concepts in modern economic thought, Ariel Rubinstein offers some powerful and entertaining reflections on his childhood, family and career. In doing so, he challenges many of the central tenets of game theory, and sheds light on the role economics can play in society at large. The book is as thought-provoking for seasoned economists as it is enlightening for newcomers to the field.

Understanding the Poverty Impact of the Global Financial Crisis in Latin America and the Caribbean

Citation

Latin America and the Rising South : Changing World, Changing Priorities

The world economy is not what it used to be twenty years ago. For most of the 20th century, the world economy was characterized by developed (North) countries acting as ‘center’ to a ‘periphery’ of developing (South) countries. However, the recent rise of developing economies suggests the need to go beyond this North-South dichotomy. This tectonic re-configuration of the global landscape has brought about significant changes to countries in the Latin America and Caribbean (LAC) region. The time is ripe for an in-depth analysis of the dynamics and nature of LAC’s external connections. This latest volume in the World Bank Latin American and Caribbean Studies series will focus on the implications of these trends for the economic development of LAC countries. In particular, trade, financial, macroeconomic, and sectoral shifts, as well as labor-market aspects will be systematically analyzed.

Making Reforms Work in the Caribbean : A Collective Action Approach to Growth

The Caribbean Growth Forum (CGF) was thus designed to respond to these concerns: to be both a forum of dialogue to identify needed reforms, and a catalyst for the implementation of agreed reform priorities, creating the needed accelerators to make reforms happen, while keeping in mind the political economy factors that have impeded reforms in the past. Since inception, the CGF process has been solidly grounded on few core principles: (i) tailoring: the approach is based on locally defined problems and solutions (home grown); (ii) action-orientation: prioritization and sequencing of reforms (e.g., combining gradual reforms with longer term structural changes) and their translation into clear, achievable and measurable targets, dashboards and roadmaps for implementation; (iii) transparency: making both targets and the process public to increase participation and shared commitments, thus creating a routine culture of public reporting to track progress openly (introduce behavioral changes); (iv) flexibility: to ensure that the process allows for adjustments if targets are not reached and to create space for innovation; and (v) accountability: infusing a sense of shared responsibility across the coalition that is supporting change, thus moving from a blaming culture to a culture of finding solutions by doing; and, eventually, anchoring the process around a small group of responsible government officials and support them in delivering policies.

Issues in Globalization

For a mind map of the lecture click here. https://drive.google.com/file/d/0B4xsUWIwgtY-Y3M0Zy0zQkstSW8/view?usp=sharing

The Presentation slides can be downloaded from issues in globalization1